Successfully operating an ad agency or media shop means running a tight ship. If you want to stay profitable, every dollar you spend needs to deliver maximum value. That’s why smart agencies are gathering credit card reward points by using RewardPay to pay their media spend and other business expenses.

Think about it. You’re not impacting your clients’ value for money in any way; nor are you breaking any tax or business rules. You’re just making the most of a golden opportunity to maximise reward points accumulation.

The extra credit card points you gain this way are very useful. Redeem them to reward top-performing employees, buy wine for Friday night drinkies and pay for travel (business or pleasure).

A quick illustration of the value you get with RewardPay:

- Imagine your monthly media spend is $20,000. With RewardPay, that level of spending earns around 400,000 Amex points annually.

- There’s a cost involved, but the points you gain are valued at around double what you pay to use the RewardPay service. A cost vs benefit analysis is below.

- Paying your media spend through RewardPay gives you up to 50 days interest-free. This benefit can help to even-out cash flow (more about that below).

Our payment portal makes it possible

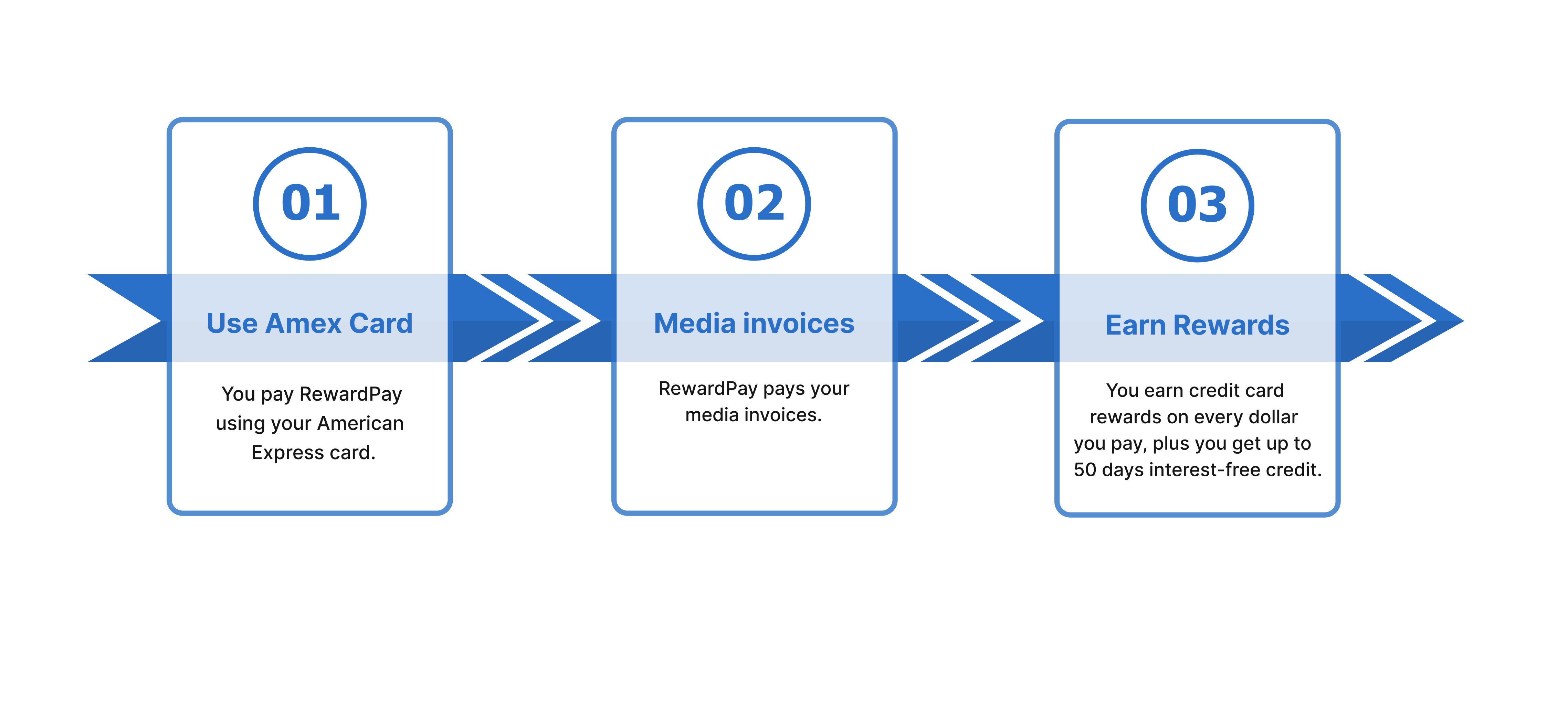

While paying business expenses with a credit card isn't a new concept, most cards put limitations on the number of points you can earn with any transaction. RewardPay is different, because we ensure you earn without limits. It’s possible because of our payment portal, a secure platform that lets you pay using an American Express card. You pay us with Amex, then we follow through by paying your bills.

You can trust that our systems are secure. We've got end-to-end encryption and strict compliance with PCI Data Security Standards in place. Your financial info is in good hands.

Which Amex card works best for RewardPay?

RewardPay has chosen to work with American Express because they provide the highest points-earning rates. In an analysis of best credit cards to use for paying media spend, USA news group CNBC named American Express® Business Gold as ‘best overall’. For Australia, the result would probably be American Express® Platinum Business.

Here are the current points-earning rates for Australia’s American Express business card line-up:

- American Express® Platinum Business Card, for up to 2.25 points per $1 spent.

- American Express ® Qantas Business Rewards Card, for up to 2 Qantas points per $1 spent.

- American Express® Business Explorer® Card, for up to 2 points per $1 spent.

- American Express® Velocity Business Card, for up to 2 Velocity (Virgin Australia) points per $1 spent.

- American Express® Gold Business Card, for up to 1.5 points per $1 spent.

If you don’t yet have an American Express card linked to a reward program, and aren’t entirely sure which card is best for your business, American Express can help. The chat tool on their website lets you communicate with an expert who knows all the cards inside out.

American Express is one of the world’s oldest and most successful brands, dating all the way back to 1850. Their first credit card was launched in 1958, so they have more than six decades of experience as a credit card provider. Their point-of-difference in the market is high points earning.

Spend points strategically to support your agency’s success

Earning Amex points by paying media bills through RewardPay unlocks a huge cache of opportunities within your card-linked American Express rewards program. The points you gather are pure spending power that you can use for business advantage (or your next holiday!).

- Reward employees for exceptional performance with gift cards purchased with points. There’s a massive range of gift cards in the American Express line up – Apple, Coles, Myer, Dan Murphys, David Jones, Flight Centre, Drummond Golf, Westfield, The Iconic, Harvey Norman, Ikea, JB Hi-Fi and Ticketmaster, just to mention a few.

- Encourage client loyalty with gifts of wine, spa vouchers, movie tickets and much more.

- Minimise business expenses by using points to purchase flights, hotel accommodation, fuel and furniture.

“From the business point of view, RewardPay has been great. We’re getting the points from American Express to offset some of our expenses. I've earned close to three million points. I've used them for airfares, I've used them for hotels, I've used them for rental cars. And again, it's reducing the expenses for the company.” Luciano Schettini, Pastabilities.

Up to 50 days interest-free credit to help your cash flow

By paying media bills and other business expenses through RewardPay, you'll enjoy more than 50 days of interest-free flexibility. This extra bit of financial flexibility is handy in lean times and seasonal slow-downs.

“When Reward Pay showed up as an option, I looked into and realised I can pay any of my suppliers - even the suppliers that don't accept Amex. It works for me in terms of helping my cash flow,” Richard Romanowski, Planet Ark Power.

Cost vs benefit: an equation that works

Any business expense can legitimately be paid with RewardPay – media bills, payroll, tax, office equipment and general costs. Here's an explanation of cost vs benefit:

- No upfront fees to sign up. As soon as you join RewardPay, you’ll have a user-friendly dashboard for managing payees and payments.

- For individual transactions up to $20,000, there's a 2.15% fee, plus GST. After tax and GST deductibility (consult your accountant for specifics), it's about 1.61%.

- Imagine your monthly media expenses are $20,000. With RewardPay, you could rack up nearly 400,000 Amex points annually.

- You might look at the 1.61% cost, which amounts to $3,864, and wonder if it's worth it. However, using air travel as an example, the redemption value of your points is around $8,000 - even after factoring in taxes, fees and surcharges for travel bookings.

Nothing to lose and everything to gain

It costs nothing to join RewardPay. Fees only apply when you set up a payment through our portal. Why not give it a try to see how the points stack up? Watch a video and see our pricing.